ADA Price Prediction: Is Now the Time to Invest in Cardano?

#ADA

- Technical Strength: ADA trades above its 20-day moving average with positive MACD momentum, suggesting short-term bullish bias

- Ecosystem Growth: Partnerships with PayFi and the upcoming Midnight Wallet airdrop demonstrate expanding utility and user adoption

- Market Position: Recognition as a top sub-$1 crypto pick amid volatility indicates strong relative strength and investor interest

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

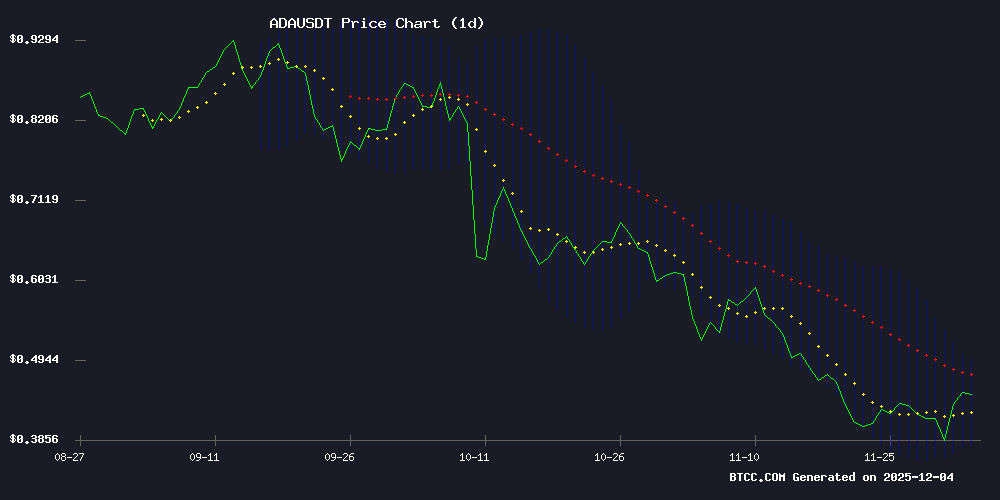

According to BTCC financial analyst Mia, ADA's current price of $0.4429 sits above its 20-day moving average of $0.4364, indicating short-term bullish momentum. The MACD reading of 0.0325 suggests positive momentum, though the negative histogram value of -0.0185 shows some divergence. The Bollinger Bands positioning shows ADA trading in the upper half of the band, with the $0.4945 upper band representing immediate resistance and the $0.3782 lower band providing support.

Market Sentiment: Positive Developments Drive ADA Optimism

BTCC financial analyst Mia notes that recent news highlights several positive developments for Cardano. The platform's partnership with PayFi, strong performance amid market volatility, and the upcoming Midnight Wallet airdrop with 7.3 billion NIGHT tokens are generating bullish sentiment. However, the mention of resistance at the 23.6% Fibonacci level suggests some technical headwinds remain.

Factors Influencing ADA's Price

ADA Rebounds Strongly as Cardano and PayFi Gain Traction

Cardano (ADA) is staging a robust recovery, bouncing off key support at $0.37 and testing resistance at $0.44. The rebound coincides with growing DeFi activity on the network, signaling renewed institutional interest in projects with real-world utility.

While Bitcoin remains range-bound, capital is flowing toward fundamentally strong altcoins. Analysts highlight a CertiK-verified PayFi project as an emerging contender, with its newly launched mobile wallet attracting strategic investors. The protocol bridges crypto and traditional finance—a narrative gaining momentum ahead of 2025.

Market sentiment suggests Cardano offers steady upside, but PayFi's infrastructure play could deliver exponential growth. Both projects exemplify the shift from speculative assets to blockchain solutions with tangible use cases.

Tapzi and Cardano Emerge as Top Sub-$1 Crypto Picks Amid Volatile Market

Investors seeking value in cryptocurrency's turbulent markets are increasingly turning to tokens priced below $1. These assets often represent early-stage opportunities with outsized growth potential. Two projects currently stand out in this category: Tapzi, a fledgling GameFi platform, and Cardano, the established blockchain network undergoing continuous evolution.

Tapzi distinguishes itself through minimalist GameFi mechanics, focusing on familiar games like chess and ludo rather than complex NFT ecosystems. Its skill-based earning model and fractional cent price point position it as an accessible entry point for retail investors. Cardano meanwhile continues to demonstrate institutional-grade blockchain capabilities, with its sub-dollar ADA token offering relative stability amid market fluctuations.

Analysts highlight this convergence of factors - Tapzi's disruptive gaming model and Cardano's technological maturity - as creating a rare window for strategic positioning. The sub-dollar price tier remains particularly sensitive to market narratives, with both projects currently benefiting from renewed interest in altcoin value propositions.

Cardano’s Momentum Captivates Market with Fresh Rally Signals

Cardano (ADA) is showing strong recovery signals as the cryptocurrency market's bullish trend gains momentum. ADA has broken through multi-year resistance levels, with technical indicators and on-chain data suggesting a potential repeat of early-cycle upward patterns seen in previous rallies.

The altcoin's price structure has shifted positively after months of struggling to maintain above $1. A recent 48-hour surge saw ADA breach a key resistance level, forming consecutive higher lows and higher highs—a classic sign of trend reversal. The double bottom pattern now approaching its neckline adds further technical credibility, though volume remains subdued.

Developer activity and whale accumulation provide fundamental support for the move. While liquidity outflows appear contained, the market watches for confirmation of bullish divergence in coming sessions.

Cardano Faces Key Resistance at 23.6% Fibonacci Level

Cardano (ADA) must break through the 23.6% Fibonacci retracement level to sustain its upward trajectory toward $0.50. The digital asset currently trades at $0.449, marking a 0.9% gain over the past 24 hours.

Market observers note that bullish momentum is required to overcome this technical barrier. A successful breach could open the path for further upside potential, while failure may lead to consolidation or retracement.

Cardano (ADA) Reclaims Key Resistance Amid Bullish Revival

Cardano's ADA has surged past a critical multi-year resistance level, igniting speculation of a sustained bullish reversal. The token's recent 48-hour rally marks a stark departure from its prolonged bearish trend, with technical indicators now mirroring early-stage breakout patterns observed in previous cycles.

Market structure has shifted decisively as ADA prints higher highs and lows, consolidating near the neckline of a double-bottom formation. While the breakout remains unconfirmed, on-chain metrics and price action suggest growing accumulation at current levels.

Cardano's Midnight Wallet Dominates with 7.3B NIGHT Tokens Ahead of Airdrop

The Cardano ecosystem braces for impact as on-chain data reveals a single Midnight wallet controls 7.3 billion NIGHT tokens—31% of the total supply. This concentration emerges days before the Glacier Drop redemption event, marking a pivotal moment for ADA's privacy-focused subsidiary chain.

Market observers note the wallet's disproportionate holdings could significantly influence token distribution during the airdrop. The Midnight project, designed to bring confidential transactions to Cardano, has seen its NIGHT token become a focal point for speculators anticipating the redemption window.

Is ADA a good investment?

Based on current technical indicators and market developments, ADA presents a cautiously optimistic investment case according to BTCC financial analyst Mia. The cryptocurrency trades above its key moving average with positive MACD momentum, while recent partnerships and ecosystem developments provide fundamental support.

Key Technical Levels:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $0.4429 | Trading above 20-day MA |

| 20-day Moving Average | $0.4364 | Support level |

| MACD | 0.0325 | Bullish momentum |

| Bollinger Upper Band | $0.4945 | Near-term resistance |

| Bollinger Lower Band | $0.3782 | Strong support zone |

The combination of technical positioning above key support levels and positive ecosystem developments suggests ADA could see further upside, particularly if it breaks through the $0.4945 resistance level. However, investors should monitor the 23.6% Fibonacci resistance level mentioned in recent analysis and consider dollar-cost averaging given cryptocurrency volatility.